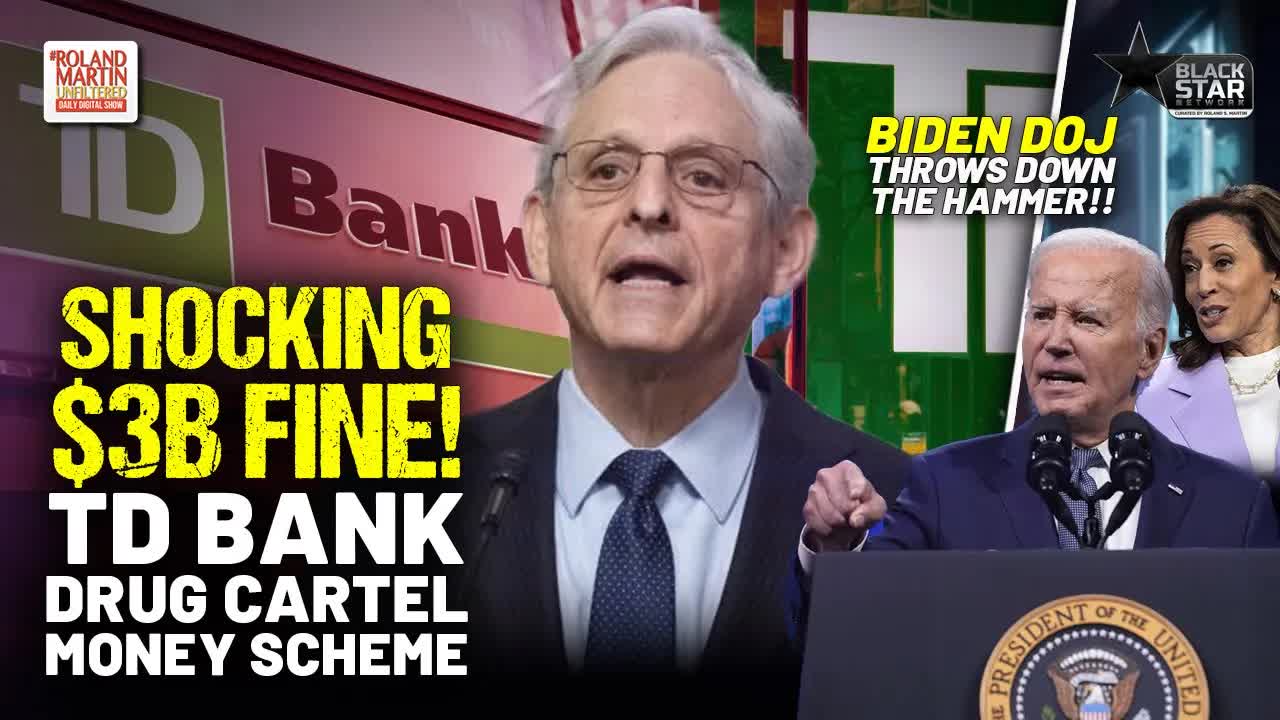

In a groundbreaking development, TD Bank has entered a guilty plea to several serious offenses, including conspiring to violate the Bank Secrecy Act and facilitating money laundering.

The bank will face a staggering criminal penalty of $1.8 billion, which, when combined with additional civil enforcement actions from various agencies, brings the total financial repercussions to nearly $3 billion.

This marks a significant moment in U.S. banking history, as TD Bank becomes the largest institution ever to plead guilty to failures related to the Bank Secrecy Act.

The bank’s actions have led to a troubling environment where financial crime was able to thrive.

By prioritizing convenience over compliance, TD Bank inadvertently positioned itself as an attractive option for criminals.

This unprecedented plea underscores not only the gravity of the bank’s failures but also the Justice Department’s commitment to holding financial institutions accountable for their roles in enabling illegal activities.

As part of the plea deal, TD Bank is mandated to fundamentally overhaul its corporate compliance program at its U.S. branch, which ranks as the 10th largest bank in the country.

Additionally, the bank will be under a three-year monitorship and will serve a five-year probation period.

While remediation efforts are already underway, TD Bank is expected to continue enhancing its anti-money laundering compliance measures to ensure lawful operations in the future.

The Justice Department’s investigation has not only targeted the bank itself but has also led to the prosecution of approximately two dozen individuals involved in various money laundering schemes that funneled over $670 million through TD Bank accounts.

So far, two employees have been charged in connection with these illicit activities, highlighting the depth of the problem within the bank.

Under the terms of the plea agreement, TD Bank is required to fully cooperate with ongoing investigations into its operations and the actions of its employees.

Failure to comply could result in further criminal charges, with the previously established facts potentially used against the bank in court.

Investigations into individual employees at all levels are still active, emphasizing that no one involved in the misconduct will be exempt from scrutiny.

Federal laws aimed at combating money laundering exist to prevent criminals from exploiting U.S. banks for their nefarious activities.

The Justice Department has made it clear that financial institutions that neglect their responsibilities are equally culpable.

TD Bank’s failure to maintain an adequate anti-money laundering program between January 2014 and October 2023 allowed three major money laundering networks to process vast sums of illicit funds through its accounts.

Over the course of six years, TD Bank neglected to monitor a staggering $18.3 trillion in customer activity.

This oversight enabled three criminal networks to launder over $670 million, with at least one scheme involving five bank employees.

Despite having an automated system designed to flag suspicious transactions, the system proved to be woefully inadequate.

One particularly egregious case involved a man known as “David,” who moved over $470 million in illicit funds through TD Bank branches.

His activities were so blatant that he even bribed bank employees with gift cards totaling more than $57,000.

Employees recognized the illegality of his actions, yet little was done to halt his operations.

In another scheme, five TD Bank employees allegedly collaborated with criminal organizations to launder $39 million to Colombia, including drug-related proceeds.

Red flags were raised internally, but the bank failed to act until law enforcement intervened.

This pattern of negligence raises serious questions about the bank’s commitment to compliance.

Moreover, a third scheme involved multiple shell companies that utilized TD Bank accounts to transfer over $100 million in illicit funds.

Despite employees flagging suspicious activities, it wasn’t until law enforcement alerted the bank that any action was taken, demonstrating a shocking level of oversight.

Throughout these incidents, bank employees openly joked about the institution’s role in facilitating criminal activity.

One compliance employee even asked a manager what “the bad guys” thought about the bank, to which the manager replied, “easy target.”

Such comments highlight a culture that prioritized convenience over ethical responsibility.

While it is entirely reasonable for banks to strive for customer convenience, TD Bank’s approach crossed a line.

The Bank Secrecy Act mandates that financial institutions implement robust compliance programs to combat money laundering.

However, TD Bank chose to prioritize profits over adherence to these legal requirements, a decision that is now costing them billions.

The recent actions taken against TD Bank echo previous high-profile cases, such as the felony guilty pleas from Binance, the world’s largest cryptocurrency exchange.

These cases serve as reminders that financial institutions must remain vigilant in safeguarding against criminal exploitation.

The Justice Department’s commitment to prosecuting non-compliance is unwavering, and the ramifications for failing to uphold these standards are severe.